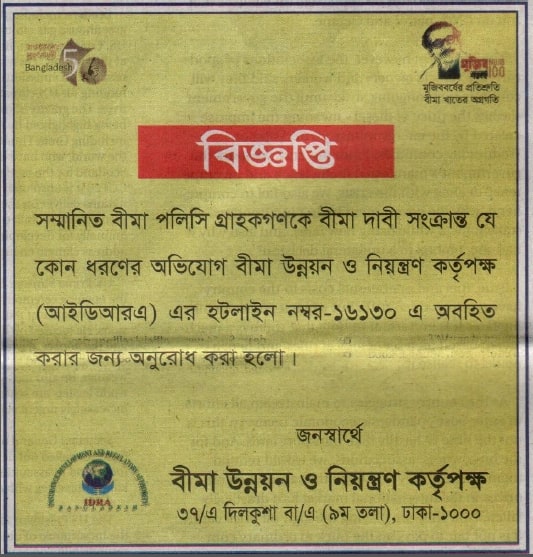

Hotline: 09613 070 071 & IDRA Hotline No. 16130 বাংলা সংস্করণ

The 25th AGM of Shareholder TIIPLC will be held on August 16,2025 at 11.00 AM. The AGM will be held virtually by using Digital Platform through the following

Hotline: 09613 070 071 & IDRA Hotline No. 16130 বাংলা সংস্করণ

Cover Act. Liabilities viz, death/bodily injury and damage to properties as per Motor Vehicle Amendment Act, 1991.

Covers loss or damage to the motor vehicle and or its accessories whilst thereon by fire, explosion, self ignition, lighting, burglary, housebreaking, theft, riot & strike, malicious damage, terrorism, earthquake, flood, typhoon, hurricane, ...

Cover liability in excess of no fault liability limits viz. BDT. 20,000 (max) for death or bodily injury and BDT. 50,000 (max) for property damage under Standard Comprehensive and Act Only Liability insurances.

a) Act Liability policy/public Liability :-This

policy provides indemnity to the insured against legal liability for

claims by the third party in respect of accidental personal injury

&/or damage to any property of third party property covered by the

insured vehicles in public place as is necessary to meet the

requirements of section 95 of the Motor Vehicles Act 1939. Increased

limit of liability is also provided in respect of public liability

policy.

b) Comprehensive Insurance Policy:- This

policy provides cover against loss or damage to the insured vehicle by

accidental external means or malicious act, Fire, External Explosion,

Lightning Self ignition, Burglary, Housebreaking and Theft. Also whilst

in transit by Road, Rail inland waterway, lift, elevator or air. Subject

to the limitations mentioned in the policy and liability to public

risks including Act liability. Rates

& terms of motor policy are governed by motor tariff and it is

binding on the insurers to follow such rates & terms. For rating

purpose, the vehicles have been classified into three classes according

to their use viz. Private Car. Motor Cycle and Commercial Vehicles.

Premium is calculated on cubic capacity and seating capacity in respect

of Private Car, Motor Cycle, while premium in respect of commercial

vehicles is calculated on tonnage capacity of the vehicles.

Takaful Islami Insurance PLC

Head Office: Monir Tower (7th, 8th & 9th Floor),

167/1, D.I.T. Extension Road,Motijheel (Fakirapool), Dhaka.